NO POWER? NO INCOME? NO PROBLEM. HOW TO GET PAID BY YOUR INSURANCE COMPANY WHEN YOU’RE RENEWABLE ENERGY PROJECT GOES UP IN FLAMES!

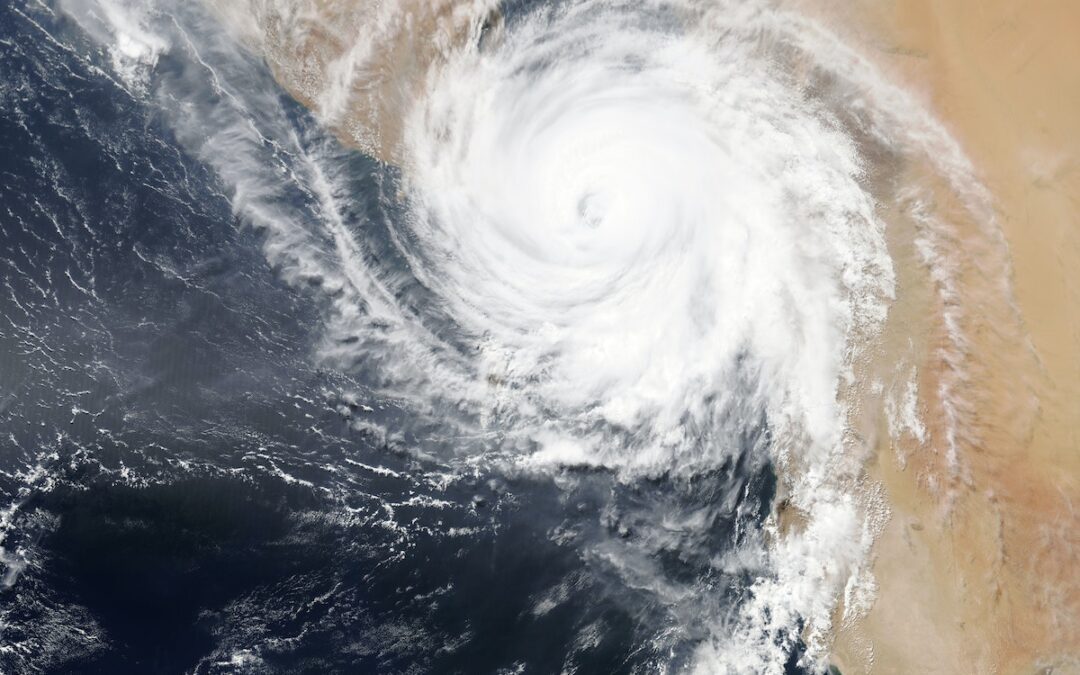

California is home to some of the world’s most notable renewable energy companies and projects. It’s also become a state prone to substantial wildfires due to recent droughts. With the fire season coming to an end, we are reminded of the dangers natural disaster pose to our renewable energy projects and infrastructure. You need only look back to the summer of 2015 when The Valley Fire in Sonoma and Lake counties laid waste to 1,900 structures and left more than 3,000 Northern Californian residents homeless.

It’s also worth mentioning that one of the most notable commercial structures suffering significant damage in this fire was Calpine’s geothermal plant. While initial estimates reported repairs to infrastructure would cost close to $35MM, little mention was made of the lost income due to having to operate at three-quarters of its normal energy output during lengthy repairs. To put that into numbers, Calpine was contributing 725 MW to the electricity grid prior to the disaster. New production was reduced to 540 MW after the fire causing income losses to the company that were in addition to the $35MM needed to repair property.

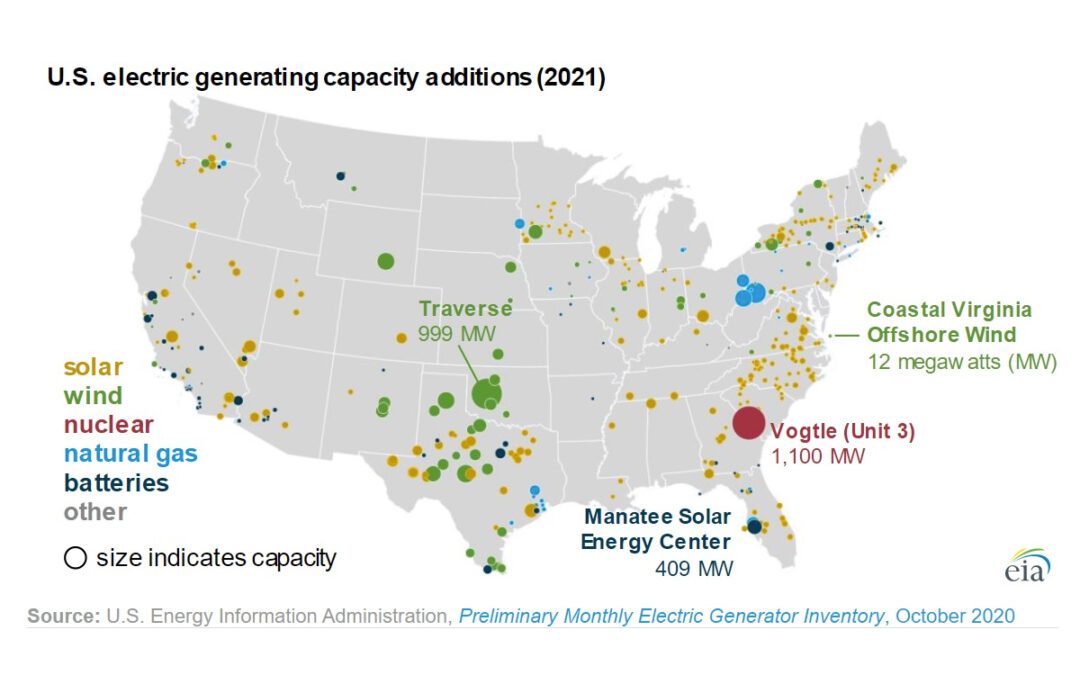

TAX CREDITS ARE INCREASING THE NUMBER OF UTILITY SCALE PROJECTS LIKE CALPINE’S

As noted in my article from March 8, 2016 titled “Finding the Balance”, the extension by congress of the Production Tax Credit (PTC) and the Investment Tax Credit (ITC) tax incentives is projected to result in $73B of new investment pouring into the renewable energy industry over the next several years. Similar sized projects to Calpine’s Northern CA plant are becoming more abundant. Like many utility scale projects, the investment tax credits will likely be leveraged to help finance the deal. However, there is an inherent risk with how the credit vests. These credits carry with them a 5 year vesting schedule in most instances, with 20% of the credit vesting each year for the first 5 years. The plant must also produce energy output at a certain level to fulfill the tax credit requirement.

SO, WHAT’S THE RISK?

If a plant were to burn to the ground due to a wildfire, equipment failure, cyber-attack, or be destroyed by some other method, the project’s investors would not meet the production requirements and the government would “claw-back” the issued tax credit dollars. This claw-back would be significant, as the $ amount often attributes to 30% of the project’s overall development financing.

HOW CAN INSURANCE HELP?

A small handful of carriers have worked to develop cutting edge insurance products to meet the needs of emerging risks associated with the Renewable Energy Industry. Coverage now addressed:

- Loss of tax credits that would have been earned or incurred

- Actual loss of income (net profit or loss before income taxes), including income from renting or leasing your covered property to others

- Continuing normal operating expenses, including payroll

- Other financial incentives listed and described in your insurance policy schedule

- “Green” soft cost expenses – Coverage for soft costs such as engineers, architects and administrative fees needed to apply for green certification, incurred because of a covered loss to covered property

- Extended lost income coverage from 12 – 36 months. Particularly important for roof mounted projects where the building may take longer to rebuild.

- Solar-Shortfall coverage to replace lost income in the event the sun does not shine at predicted levels.