by Katie Doyle | Apr 29, 2020 | Insurance, Operations & Maintenance, Renewable Energy, Risk

SAN FRANCISCO, CA (April 22, 2020) – Renewable Guard Insurance Brokers, LLC a leading independent renewable energy insurance brokerage firm, is pleased to announce a new partnership with Hailsure Underwriting Managers, LLC to deliver a new parametric hail insurance...

by mcosgrave | Aug 10, 2018 | Insurance, Renewable Energy

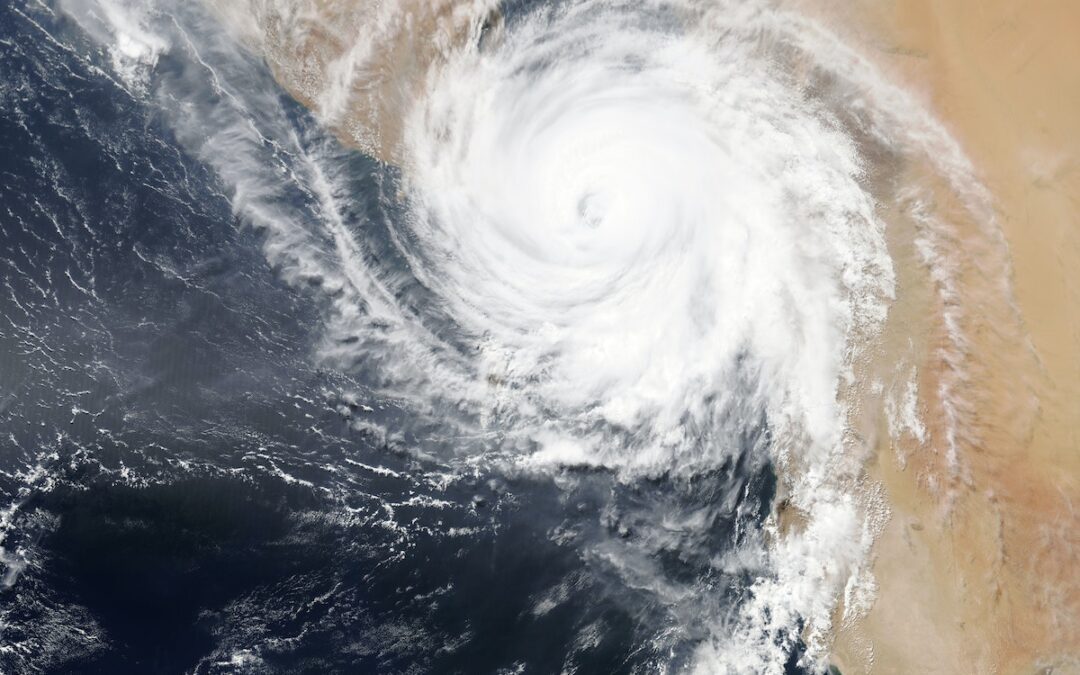

6 Hurricane Insurance & Loss Prevention Strategies Renewable Energy Owners Should Implement Today BY: Michael Cosgrave, CIC, CRM | Renewable Guard Certified Risk Manager Hurricane season runs between June 1st and November 30th and you need only look back to 2017...

by mcosgrave | Jun 1, 2017 | Industry Insights, Insurance, Renewable Energy

The Paris Climate Agreement shows us how Political Risk can impact the Renewable Energy Industry, while also shedding light on the need for increased private financing. Bill Gates and his Breakthrough Energy Fund shows us just how to get that done…...

by mcosgrave | Mar 20, 2017 | Industry Insights, Insurance, Renewable Energy, Risk

THE ENVIRONMENTAL PROTECTION AGENCY (EPA) HAS A NEW CHIEF AND THERE IS GROWING SPECULATION ON WHAT THAT MIGHT MEAN FOR THE RENEWABLE ENERGY INDUSTRY & ITS FEDERAL INVESTMENT TAX CREDITS (ITC) – HERE’S A LOOK AT MANAGING POLITICAL RISK In an article I wrote...

by mcosgrave | Mar 20, 2017 | Industry Insights, Insurance, Renewable Energy, Risk

NO POWER? NO INCOME? NO PROBLEM. HOW TO GET PAID BY YOUR INSURANCE COMPANY WHEN YOU’RE RENEWABLE ENERGY PROJECT GOES UP IN FLAMES! California is home to some of the world’s most notable renewable energy companies and projects. It’s also become a state prone to...

by mcosgrave | Mar 20, 2017 | Industry Insights, Insurance, Renewable Energy, Risk

THE OLYMPICS ARE DRAWING ATTENTION TO RISKS ASSOCIATED WITH ADVANCING RENEWABLE ENERGY SUPPLY IN DEVELOPING COUNTRIES The 2016 summer Olympics are just getting under way in Brazil with what the country promised to be the “greenest games” ever, but a closer look at the...